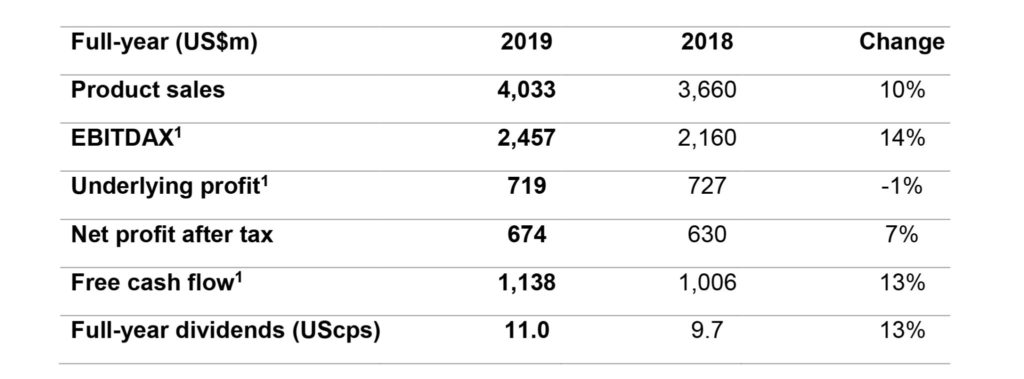

SANTOS REPORTS RECORD ANNUAL FREE CASH FLOW OF $1.1 BILLION, 7% INCREASE IN NET PROFIT AND 13% INCREASE IN FULL-YEAR DIVIDENDS

Santos today announced its full-year results for 2019, reporting both record EBITDAX and free cash flow.

The Board has resolved to pay a final dividend of US5.0 cents per share fully-franked, bringing full-year dividends to US11.0 cents per share fully-franked, up 13% on the previous year. The final dividend is in-line with Santos’ sustainable dividend policy which targets a range of 10% to 30% payout of free cash flow.

Santos Managing Director and Chief Executive Officer Kevin Gallagher said: “Today’s announcement of full-year results demonstrates the strength of our cash-generative operating model.”

“Santos has delivered strong financial results with EBITDAX1 up 14% to a record US$2.5 billion and free cash flow1 up 13% to over US$1.1 billion. Reported net profitafter tax increased by 7% to US$674 million.

“Consistent application of our disciplined operating model continues to deliver cost reductions and efficiencies, with normalised production costs2 down 8% to US$6.97/boe.

“The year was highlighted by record onshore drilling performance, lower unit costs, successful integration of the Quadrant acquisition and significant progress on our diversified portfolio of growth projects.

“The acquisition of ConocoPhillips assets in northern Australia and Timor-Leste announced in October is fully-aligned with our growth strategy to build on existing infrastructure positions and delivers operatorship and control of strategic LNG infrastructure at Darwin.

“The acquisition is expected to complete around the end of the first quarter of 2020, subject to third-party consents and regulatory approvals.

“Following completion of the ConocoPhillips’ acquisition, we expect to take a final investment decision on the Barossa project to backfill Darwin LNG in the second quarter.

“Barossa is making good progress towards FID, with technical assurance processes well advanced and key contracts for the FPSO, subsea production system and export pipeline all awarded. The Barossa and DLNG partners are in advanced discussions to finalise the processing agreement for Barossa gas to support a final investment decision.

“We are also targeting a FEED-entry decision on the exciting Dorado liquids project in the second quarter.

“In the Cooper Basin, our focus on low-cost, efficient operations contributed to stronger annual production and 183% reserves replacement. We have also taken a FEED-entry decision for the Moomba carbon capture and storage project.

“At GLNG, our disciplined operating model continues to support a development plan to unlock more gas over time and we recently lifted guidance to ~6.2 mtpa LNG sales from this year.

“All of this growth activity is consistent with reaching our goal of more than 120 million barrels of oil equivalent production by 2025.

“This growth is enabled by our strong balance sheet and balanced asset portfolio, which provides sustainable free cash flow through the oil price cycle,” Mr Gallagher said.

Final dividend

The Board has resolved to pay a 2019 final dividend of US5.0 cents per share fully-franked, in line with the company’s sustainable dividend policy which targets a range of 10% to 30% payout of free cash flow.

The final dividend will be paid on 26 March 2020 to registered shareholders as at the record date of 26 February 2020.

Santos dividends are determined and declared in US dollars and paid to shareholders in Australian dollars. Currency conversion for the interim dividend will be based on the exchange rate on the record date of 26 February 2020. The Dividend Reinvestment Plan will not be offered for the 2019 final dividend.

Conference call and live webcast

Santos will host a conference call and live webcast for analysts and investors today at 11:00am AEDT.

Dial-in numbers for the conference call are listed below. Please quote passcode ID: 10003979.

For locations within Australia dial toll-free 1800 870 643 or toll 02 9007 3187.

For other countries, please use one of the following toll-free numbers: Canada (1 855 881 1339); China (4001 200 659); Hong Kong (800 966 806); India (0008 0010 08443); Japan (005 3116 1281); New Zealand (0800 453 055); Singapore (800 1012 785); United Kingdom (0800 051 8245); United States (1 855 881 1339). For all other countries or operator assistance, please call +61 2 9007 3187.

The webcast will be available on Santos’ website from 11:00am AEDT at www.santos.com.